In this article I will be talking about Brazil Fast Food Company (BOBS.OB). Bob’s was founded in 1952 by American tennis player Bob Falkenberg and serves hamburgers and sandwiches with a Brazilian twist, shakes, French fries, and other typical fast food offerings. BOBS has grown to become the second biggest fast food chain in Brazil with operations in every state of the country, Angola, and Chile.

When I talk about BOBS in all capital letters I mean the company as a whole. When I refer to Bob’s it means just the fast food burger chain.

A fellow value investor mentioned on my blog that I should research BOBS as a possible investment since I have already researched and written articles on a couple fast food companies; Jack In The Box (JACK) and Wendy’s (WEN). Also with my recent turn towards concentrating on micro caps he thought I might find this company interesting.

I have found BOBS to be very interesting and it has turned into only the fifth company I have bought into this year as it meets most of my criteria for things I look for in a potential investment. Some main points of interest are: I have found BOBS to be substantially undervalued, I believe BOBS to have a competitive advantage, or moat that has been growing in the past several years, the company is very small and under followed, and its sales and margins have also been growing in recent years.

Introduction

For the better part of the last 60 years Brazil Fast Food has been operating and franchising only its Bob’s fast food burger chain and expanding the chains reach throughout Brazil. Here is a history of BOBS up to 2004 that goes over its many struggles and near death multiple times. Very interesting read especially when you consider what they have become now. After updating its stores, changing the Bob’s logo, enacting cost cutting and efficiency measures, and changing its strategy to become a multi-brand restaurant company with partnerships to bring KFC and Pizza Hut restaurants to Brazil, and through acquiring Doggi’s and Yoggi’s, BOBS has expanded its restaurant count dramatically and expanded from just selling burgers, sandwiches, shakes, and fries, into selling KFC’s chicken related products, pizza’s, hot dogs, frozen yogurt and smoothies to become the second largest fast food chain in Brazil.

As we found out in my Wendy’s article, growth is not always a good thing if your cost of capital is very high due to debt and other costs. Luckily, BOBS debt is at a very manageable level and BOBS has been lowering its costs over the last few years. The growth in the amount and type of products along with the growing restaurant count has helped grow revenues and margins at pretty substantial percentages over the last several years. Most importantly of all, I believe BOBS is growing at less than its cost of capital because as it has grown its store count and sales it has become more profitable.

Also helping to grow BOBS as a whole is that I believe that it has at least some minor competitive advantages which it has had for a while now but has only recently been fully unleashed due to BOBS growing scale as it pertains to its growing number of restaurants, and its cost cutting and efficiency measures over the last several years. At this point I cannot say for certain whether the small moat I see for BOBS is sustainable for the long term, but this is the first company I have evaluated in a while where I see some kind of very clear moat.

Overview of Operations and Subsidiaries

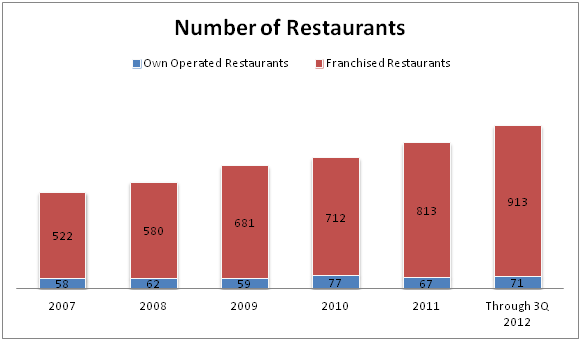

Before 2007, Brazil Fast Food Company just comprised of Bob’s burger chain which I described above. In 2007 BOBS as a whole started on its path towards becoming a multi-brand restaurant operation as it agreed with Yum Brands (YUM) to open KFC restaurants in Brazil. In 2009 BOBS further expanded to include operating some Pizza Hut’s in Brazil and it also acquired Doggi’s hot dog chain. In 2012 BOBS further expanded as it acquired Yoggi’s frozen yogurt and smoothie company. Since its beginnings as a regional company in Brazil with the bulk of its operations in the Southeastern portion of the country, BOBS has grown into the second biggest fast food chain in Brazil behind only McDonald’s (MCD) with operations in every state in Brazil. BOBS has also started to grow outside of Brazil as it now has operations in Chile and Angola. Below is a chart showing how BOBS has grown its restaurant count since 2007.

Restaurant count has grown by 7% annually since 2007. Its growing size and now countrywide operations have enabled BOBS to sign some very favorable agreements with suppliers. Here are some direct quotes from BOBS 3Q 2012 10Q about the favorable relationship with its trade partners. Emphasis is mine.

“We enter into agreements with beverage and food suppliers and for each product, we negotiate a monthly performance bonus which will depend on the product sales volume to our chains (including both own-operated and franchise operated). The performance bonus can be paid monthly or in advance (which are estimated), depending on the agreement terms negotiated with each supplier. The performance bonus is recognized as a credit in our Consolidated Statements of Operations (under “Revenues from Trade Partners”). Such revenue is recorded when cash from vendors is received, since it is difficult to estimate the receivable amount and significant doubts about its collectability exists until the vendor agrees with the exact bonus amounts.”

‘The rise in the number of franchisees, from 774 on September 30, 2011 to 916 on September 30, 2012, together with the expansion of the multi-brand concept, has given the Company’s management greater bargaining power with its suppliers. Such increase of point sales did not derived an increase on Revenue from Trade Partners from 2011 to 2012, because the Company had agreements with new trade partners during 2011 and 2010 which originated bonus paid in advance. The bonus recorded during 2012 was from the regular business since no further advances were received during 2012.”

BOBS also has several exclusivity agreements including with Coca-Cola (KO).

“We participate in long-term exclusivity agreements with Coca-Cola, for its soft-drink products, Ambev, the biggest Brazilian brewery company, Farm Frites, the Argentinean producer of French fries, and Sadia, one of the biggest meat processors in Brazil, as well as with Novartis Nutrition for its Ovomaltine chocolate. These agreements are extensive from four to five years. The Coca-Cola agreement was amended in 2008 to extend the exclusivity period to April 2013.”

“Amounts received from the Coca-Cola exclusivity agreements (see note 12) as well as amounts received from other suppliers linked to exclusivity agreements are recorded as deferred income and are being recognized on a straight line basis over the term of such agreements or the related supply agreement. The Company accounts for other supplier exclusivity fees on a straight-line basis over the related supply agreement. The Coca-Cola agreement was amended in 2000 to extend the exclusivity period to 2008. Later amended and extended until April, 2013. Performance bonuses may also include exclusivity agreements, which are normally paid in advance by suppliers.”

Due to its growing size and economies of scale BOBS has gained a competitive advantage over competitors by being able to receive “bonus payments” in advance from some of its suppliers. Its size and scale has enabled the company to sign these preferential and exclusive agreements, which have helped expand BOBS competitive position and moat in my opinion. Another reason I think BOBS has at least a minor moat is because it has been able to raise prices in recent years without losing sales which has helped to raise margins.

BOBS has had these preferential agreements in place for years, and hopefully will be able to continue them for years to come.

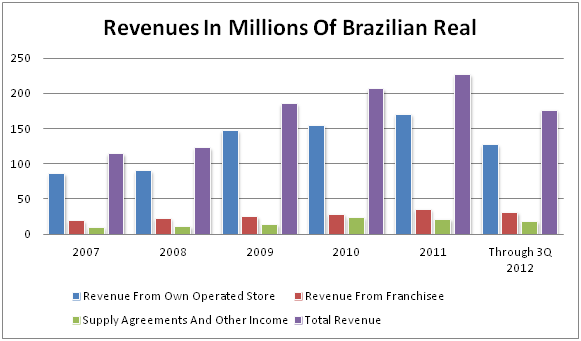

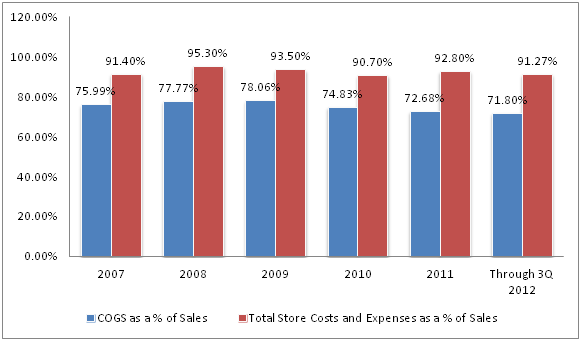

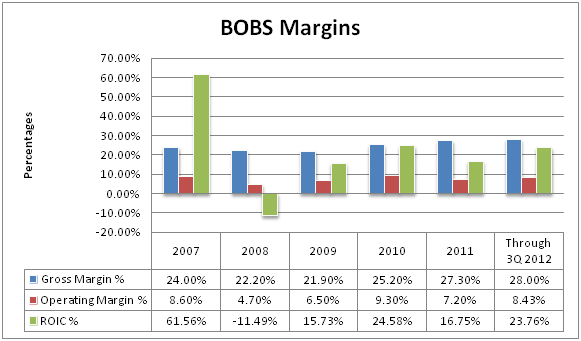

Due to BOBS growing store count, the agreements above, and the moat that I think it has, BOBS has been able to improve its sales, reduce its costs, and improve margins in recent years. Numbers in below charts are taken from Morningstar or BOBS filings.

As you can see in the above charts as BOBS restaurant count has grown, it sales have gone up, costs have gone down, and margins have gone up, substantially so since 2008. As BOBS continues to grow the same three things should continue to happen as BOBS should continue to compound its economies of scale: More restaurants means more sales, more restaurants means more compact grouping of restaurants which means lower costs and higher margins. It seems that BOBS has taken some lessons on how to cultivate and grow competitive advantages from companies such as Wal-Mart (WMT).

Margins

All numbers are taken from Morningstar, Yahoo Finance, or BOBS financial reports unless otherwise noted.

| Gross Margin TTM |

28.00% |

| Gross Margin 5 Year Average |

24.12% |

| Gross Margin 10 Year Average |

24.53% |

| Op Margin TTM |

8.43% |

| Op Margin 5 Year Average |

7.26% |

| Op Margin 10 Year Average |

5.39% |

| ROE TTM |

31.64% |

| ROE 5 Year Average |

31.35% |

| ROIC TTM |

23.76% |

| ROIC 5 Year Average |

21.43% |

| My ROIC Calculation With Goodwill |

45.10% |

| My ROIC Calculation Without Goodwill |

48.30% |

| My ROIC TTM With Goodwill Using Total Obligations |

15.56% |

| My ROIC TTM Without Goodwill Using Total Obligations |

15.25% |

| FCF/Sales TTM |

-3.54% |

| FCF/Sales 5 Year Average |

-1.43% |

| FCF/Sales 10 Year Average |

-1.39% |

| P/B Current | 2.5 |

| Insider Ownership Current |

70.36% |

| My EV/EBIT Current |

2.72 |

| My TEV/EBIT Current |

6.75 |

| Working Capital TTM | 22 $R Million |

| Working Capital 5 Yr Avg | 0.4 $R Million |

| Working Capital 10 Yr Avg | -3.1 $R Million |

| Book Value Per Share Current |

$3.17 |

| Book Value Per Share 5 Yr Avg |

$1.89 |

| Float Score Current |

0.88 |

| Float Intensity |

0.6 |

| Debt Comparisons: | |

| Total Debt as a % of Balance Sheet TTM |

16.78% |

| Total Debt as a % of Balance Sheet 5 year Average |

16.40% |

| Current Assets to Current Liabilities |

1.56 |

| Total Debt to Equity |

1.71 |

| Total Debt to Total Assets |

72% |

| Total Obligations and Debt/EBIT |

4.36 |

Margin Thoughts

Please reference my Wendy’s or Jack in the Box articles linked above to see how BOBS compares to the other fast food companies. TEV/EBIT and last three debt numbers talked about also include total obligations.

- Almost across the board BOBS margins have been improving over the 5 and 10 year periods I looked at. Especially impressive are its ROE and ROIC.

- In comparison to the other fast food companies I have evaluated, BOBS margins are at worst about at the industry average or better than those companies.

- My estimates of ROIC make the company look absolutely exceptional as I estimate that without total obligations its ROIC is 45.1% with goodwill, and 48.3% without goodwill. Even if I count total obligations its ROIC with goodwill is 15.25%, and without goodwill is 15.56%. Numbers that are close to McDonald’s ROIC.

- Even if we just count BOBS 5 years average ROIC using Morningstar’s numbers of 21.43%, which is what I used when I evaluated the other fast food companies, its margin is 6.35% points better than the industry average, and better than McDonald’s by 4.05% points. Its ROIC is only bested by Yum Brands ROIC which is inflated by debt unlike BOBS.

- FCF/Sales for BOBS is worse than the industry average by 8.78% points and regularly negative over the past several years, and still negative this year.

- I think that its FCF/Sales margin is negative due to cap ex related to renovating and updating some of its restaurants.

- BOBS P/B is lower than the other fast food companies by a substantial margin. The only company with a lower P/B is Wendy’s which as I talked about in my article on them, should be higher.

- Insider ownership above 70% for BOBS is fantastic, especially in comparison to the other fast food companies. BOBS is effectively a controlled family run company as four individuals own a combined 63.2% of BOBS as of the 2011 annual report: Ricardo Figueiredo Bomeny; the CEO and CFO of BOBS. Jose Ricardo Bosquet Bomeny; father of Ricardo and brother of Gustavo, business partner with Romulo and owns 20 of BOBS franchised restaurants. Romulo Borges Fonseca; owns 22 of BOBS franchised restaurants and business partner with Jose. Gustavo Figueiredo Bomeny; brother of Jose and uncle of Ricardo.

- I am estimating BOBS EV/EBIT to be only 2.72 and it’s TEV/EBIT to be only 6.75. BOBS EV/EBIT is lower than any company I have evaluated thus far and it is lower than the other fast food companies I have evaluated whose EV/EBIT average including Wendy’s is 20.12. As I have stated before, I like to buy companies that have EV/EBIT and TEV/EBIT ratios lower than 8 so BOBS on a relative basis looks very cheap, especially when you consider it’s very high ROE and ROIC and other margins that have been growing.

- Book value has been growing and BOBS debt levels look very sustainable to me.

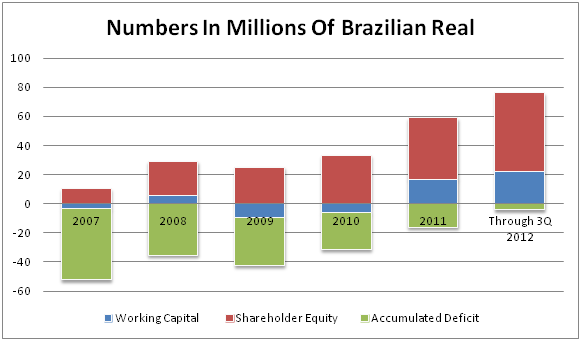

Due to the sales and margin growth mentioned above, working capital has gone from negative for the better part of the past decade to now being solidly positive, BOBS accumulated deficit has almost disappeared and shareholders equity has improved drastically, all of which can be seen in the chart below.

Other Things Of Note

- BOBS intends to focus its efforts on expanding both the number of its franchisees and the number of its franchised retail outlets, neither of which are expected to require significant capital expenditure. In addition, the expansion will provide income derived from initial fees charged on new franchised locations.

- BOBS franchise agreements generally require the franchisee of a traditional Bob’s burger restaurant to pay us an initial fee of $R 60,000, which is lower for kiosks and small stores, and additional monthly royalties fees equal to 5.0% of the franchisee’s gross sales. Bob’s fast food burger restaurants make up the vast majority of total restaurants in BOBS system.

- Lowered franchise fee in recent years from $R 90,000 to $R 60,000 to help attract more franchisees.

- BOBS has bought back shares recently and is authorized to buy back more shares. I think management has bought back shares at reasonable prices and I think now would be a good time to buy back even more shares. On December 5th, 2012 Mr. Romulo Borges Fonseca bought an additional 30,500 shares in the open market. I love to see buys from insiders who acquire their shares in the open market. Insiders generally only buy for a couple reasons: They think the company is undervalued, and/or that the company is going to perform well into the future.

- Operating margin for franchises used to be over 80%. Recently it has dropped into the mid 60% range and it seems to have stabilized in that area. It looks like the drop in franchise operating margin is due to franchise related costs rising.

- BOBS has been an OTC listed company for years, and this year it deregistered its shares with the SEC to save money every year, approximately $300,000. BOBS management says that it will continue to provide quarterly and annual reports to shareholders and that it will retain its reporting standards at the level they are at now. BOBS management has been in place for nearly 20 years so these things do not bother me that much as management has done a good job running the company over the years.

- There are only 51 current shareholders of BOBS stock so the company is very under followed.

- BOBS has substantial tax loss carry forwards NOL’s: As of December 31, 2011 relating to income tax were R$31.6 million, $1.88 per share, and to social contribution tax were R$57.6 million, $3.42 per share. Social contribution tax is similar to the corporate tax here in the US.

- Due to its small size with a market cap around $65 million, only 51 shareholders, and it being a controlled company with 70% of BOBS owned by insiders and/or affiliates of the company, average daily volume is only 2,000 shares, and in the past two weeks about half of the days the market has been open there have been no shares traded.

- Same store sales have been rising in the 4% range every year since 2007.

Intrinsic Valuations

These valuations were done by me, using my estimates and are not a recommendation to buy stock in any of the companies mentioned. Do your own homework.

Valuations were done using BOBS 2011 10K and 2012 third quarter 10Q. All numbers are in millions of Brazilian Real, except per share information, unless otherwise noted.

Low Estimate of Intrinsic Value

| Numbers: | ||||

| Revenue: |

237 |

|||

| Multiplied By: | ||||

| Average 5 year EBIT %: |

7.26% |

|||

| Equals: | ||||

| Estimated EBIT of: |

16.99 |

|||

| Multiplied By: | ||||

| Assumed Fair Value Multiple of EBIT: | 8X | |||

| Equals: | ||||

| Estimated Fair Enterprise Value of STRT: |

135.92 |

|||

| Plus: | ||||

| Cash, Cash Equivalents, and Short Term Investments: |

28.4 |

|||

| Minus: | ||||

| Total Debt: |

21 |

|||

| Equals: | ||||

| Estimated Fair Value of Common Equity: |

143.32 |

|||

| Divided By: | ||||

| Number of Shares: |

8.1 |

|||

| Equals: | 17.69 R$ per share. | |||

| Equals: | $8.48 per share. | |||

Base and High Estimate of Intrinsic Value

EBIT and net cash valuation

Cash and cash equivalents are 28.4

Short term investments are 0

Total current liabilities are 38.7

Number of shares are 8.1

Cash and cash equivalents + short-term investments – total current liabilities=

- 28.4-38.7=-10.3/8.1=-1.27 R$ per share=-$0.61 per in net cash per share.

BOBS has a trailing twelve month EBIT of.

5X, 8X, 11X, and 14X EBIT + cash and cash equivalents + short-term investments:

- 5X21.2=106+28.4=134.4/8.1=16.59 R$ per share=$7.93 per share.

- 8X21.2=169.6+28.4=198/8.1=24.44 R$ per share=$11.69 per share.

- 11X21.2=233.2+28.4=261.6/8.1=32.30 R$ per share=$15.45 per share.

- 14X21.2=296.8+28.4=325.2/8.1=40.15 R$ per share=$19.20 per share.

From this valuation I would use the 8X and 11X estimates of intrinsic value as my base and high estimates of intrinsic value respectively. None of the above valuations takes into account BOBS $5.30 per share worth of NOL’s or BOBS future growth.

Relative Valuations

- As I said above, I like to buy companies whose EV/EBIT and TEV/EBIT ratios are lower than 8 and BOBS ratios are at 2.72 and 6.75 respectively. BOBS EV/EBIT ratio is the lowest I have found out of the companies that I have done full evaluations on.

- Its P/B ratio is also quite a bit lower than other fast food companies.

- BOBS P/E ratio of 9.1 is less than half of the industry P/E of 19.8.

I found BOBS to be cheap on an intrinsic value basis and it also looks to be equally cheap on a relative valuation basis. On an EV/EBIT basis, BOBS is the lowest valued company I have fully analyzed which is a bit shocking considering its high ROIC and other margins, and the moat that I think it has.

Competitors

- McDonald’s (MCD): The number one fast food chain in Brazil and fast food behemoth around the world always provides stiff competition to smaller companies. Here is some information on Arcos Dorados (ARCO)the largest operator of McDonald’s restaurants in Latin America and the world’s largest McDonald’s franchisee. As of its 2011 10K it had 662 McDonald’s restaurants in Brazil. Arcos Dorados’ margins are quite a bit worse than BOBS margins. Overall McDonald’s has more than 1,000 restaurants in Brazil.

- Giraffas: A private company with around 400 restaurants most of which are in Brazil, it has recently started opening restaurants in South Florida. Serves similar food as Bobs burger chain.

- Yogoberry: Another private company who has more than 100 restaurants in Brazil. Will be competing with BOBS latest acquisition Yoggi’s in the frozen yogurt and smoothie arena.

- Various other fast food offerings including from Japanese, Middle Eastern, and other typical fast food restaurants.

The fast food service industry is very competitive in Brazil as it is here in the US with peoples income being sought after by a plethora of restaurants and fast food companies. I think the major threat is of course McDonald’s as BOBS other local competitors are generally quite a bit smaller than it. I think that due to the moat I see within BOBS, along with its growing size, and expansion into pizza, frozen yogurt, and chicken, that it can compete very well with the competition it has in Brazil, and continue to grow its store count profitably.

Pros

- BOBS is cheap on an intrinsic value and relative value basis.

- I think BOBS has a small and growing moat that should continue to grow as BOBS restaurant count gets bigger.

- BOBS margins generally have been growing over the past five years. In some cases by multiple percentage points. Some of BOBS margins are even better than McDonald’s and quite a bit better than Arcos Dorados’ run McDonald’s restaurants in Latin America.

- BOBS has signed exclusivity agreements with several companies including Coke, and also enjoys preferential agreements with its suppliers.

- BOBS has $5.30 per share worth of NOL’s that are not even counted in any of my valuations.

- BOBS has a low and sustainable amount of debt.

- Its book value per share has been growing.

- BOBS has almost eliminated its accumulated deficit, made its working capital positive after it being negative for most of the last decade, and substantially increased shareholders equity.

- COGS and total restaurants costs and expenses as percentages of sales have been lowered by multiple percentage points in recent years.

- The company is effectively controlled by four individuals who have thus far done a very good job of running the company.

- BOBS has bought back some shares and has the authorization to buy back more shares.

- BOBS can grow its restaurants through franchisees at minimal cap ex expenses. Franchise operating margin has been in the mid 60% range recently.

- Brazil has a growing middle class that should help grow sales further.

Cons

- Although I think BOBS has a small and growing moat, it may not be a long term sustainable competitive advantage due to competition and possible loss of exclusivity and preferential trade partner agreements.

- BOBS does not create consistent positive FCF.

- BOBS FCF/Sales margin is below the average of the other fast food companies I have evaluated and it is also negative.

- Franchise operating margin has dropped from over 80% to the mid 60% range in recent years.

- Stiff competition including McDonald’s in Brazil.

Potential Catalysts

- Confederations Cup in 2013, FIFA World Cup in 2014, and the Olympics in 2016, all of which are in Brazil, will bring millions of tourists to Brazil which should help grow BOBS revenues further in the short and medium term.

- BOBS growing franchise store count will help grow BOBS moat as margins are very high and cap ex is very low when opening new franchised restaurants.

- BOBS moat may not be sustainable over the long term due to competition and possible loss of exclusivity and preferential trade partner agreements which would most likely hurt the company.

- Brazil’s growing middle class should also help grow sales.

Conclusion

Brazil Fast Food Company, BOBS, has turned out to be a very interesting company to me. From its near death experiences in the mid 90’s and early 2000’s, to now being the number two fast food chain in Brazil, its growing store count and margins, and the various other things I have talked about in this article I have come away very impressed with BOBS as a whole and its management.

I think that BOBS is very undervalued on an intrinsic value and relative value basis and I think that it should conservatively be valued somewhere between $11.50 and $16.00 per share, not including the $5.30 per share in NOL’s that it currently has. Adding the NOL’s to my estimates of value would take its estimated value up to between $16.50-$22 per share which is the range that I think BOBS should be selling at, and what I think its private market value is. Even leaving the NOL’s out of the equation, BOBS is selling currently at only $8 per share which is a 32% discount to the absolute minimum I think BOBS is worth at $11.50 per share. I think that BOBS has a moat that could possibly grow over time, and that the company has catalysts in the short and medium term that could help unlock some of its value.

Warren Buffett always says that if you buy good companies that have some kind of moat at fair prices, that you will do very well investing over the years. I think BOBS is a good company with a moat that is currently selling at a very cheap price and I think I will do very well holding it over the years as I have bought its shares in my personal account and the accounts I manage.